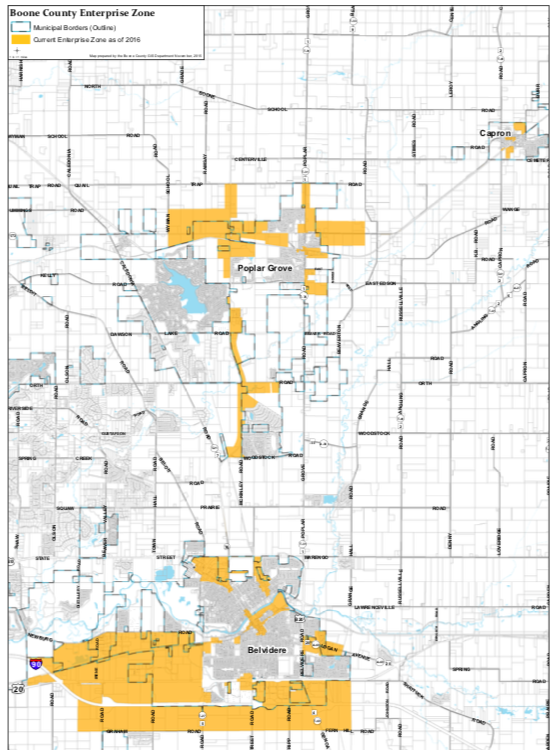

Incentives Exist in Enterprise Zones of Boone County

2 Sep 2020

Businesses within Boone County Enterprise Zones have several incentives to save money available now! Growth Dimensions Economic Development and officials from Boone County or local cities and villages are available to help local businesses step through the specifics necessary to ensure companies receive the maximum benefits possible.

An Enterprise Zone is a geographic area granted by government organizations to have special public assistance such as tax breaks or regulatory exemptions. In Illinois, Enterprise Zones are intended to stimulate economic growth and neighborhood revitalization in targeted areas of the state through state and local tax incentives, regulatory relief and improved governmental services.

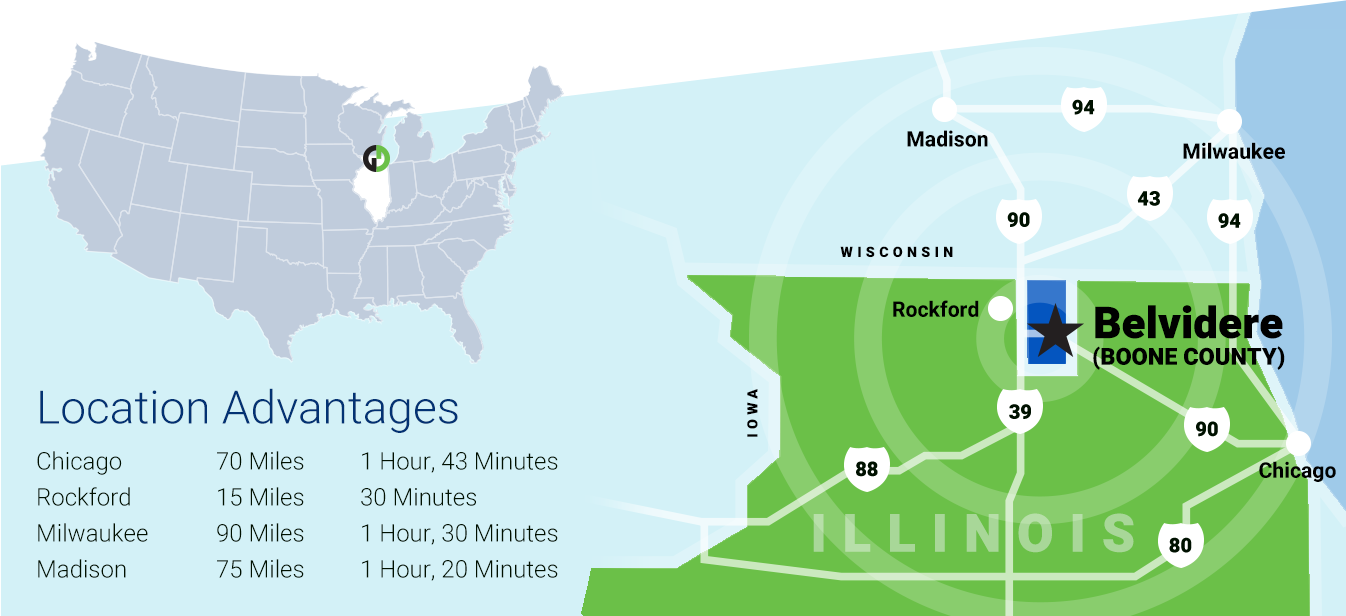

Boone County has had one of the most successful Enterprise Zones in the state in terms of helping businesses create and retain thousands of jobs and invest hundreds of millions of dollars while reaping substantial tax and fee savings. Originally certified in 1985, the current Enterprise Zone Map of Boone County can be viewed with this link or viewed in the map below.

Required Steps

There are a few steps businesses should take to ensure they receive their maximum savings. First, any business within an Enterprise Zone planning a capital improvement should file a building permit with their county, city or village. The second step is to file an application with Growth Dimensions, the program facilitator within Boone County. Businesses save 50% off the building permit fee if they do so. Follow this link to get an estimate on the savings possible for your business. Large businesses within the county already taking advantage of the program include Fiat Chrysler Automotive and General Mills. But Heather Wick, Business Enterprise Manager at Growth Dimensions, states the size of the business does not factor into the savings determination.

“You can have a 500 square-foot office and be running a one-person operation and still qualify,” she said. “The biggest reason we see for businesses not receiving their savings is they do not file for a building permit.”

A property qualifies for the advantages if it:

- Is a capital improvement/addition which increases the assessed property value.

- Is a new or used tangible building or structural component of a building.

- Is depreciable and has a useful life of four or more years as of the date placed in service in an enterprise zone

- Is used in the enterprise zone by that taxpayer

- Has not been previously used in Illinois in such a manner and by such a person as would qualify for the credit.

Typical examples of qualified property are buildings, structural components of buildings, elevators, materials tanks, boilers and major computer installations. Examples of property typically not qualifying are land, inventories, small personal computers or trademarks.

Enterprise Zone Incentives*

Businesses can take advantage of local and state incentives with capital improvement programs in Boone County Enterprise Zones. Individual Belvidere businesses have recently been able to save between $850 and $2,600 on remodeling projects involving material costs between $12,000 and $37,000. The most typical savings concern property taxes and building permits. Most businesses can receive a property tax abatement on real property located within an Enterprise Zone upon which new improvements have been constructed or upon which existing improvements have been renovated or rehabilitated. The abatement is only for the portion of taxes on improvements to the property and is scheduled in increments of 80% the first year, 60% the second year, 40% the third year and 20% the fourth year. And 50% of the building permit will be waived by filling out the application.

“A business is really missing out on a large amount of savings if they do not complete the application and file for a building permit right away,” said Wick. “There may be instances where a permit is not needed, in which Growth Dimensions works with local building departments to make the determination. If a permit is not required, the business can still receive the other incentives if requirements are met.”

The state incentives possible are as follows:

- The Sales Tax Deduction allows retailers to deduct sales receipts for building materials with Enterprise Zone real estate for remodeling, rehabilitation or new construction. Eligible materials are common building materials such as lumber, bricks, cement, windows, doors, insulation, roofing materials & sheet metal; plumbing systems & components such as bathtubs, sinks, faucets, garbage disposals, water pumps, water heaters,water softeners & water pipes; heating systems & components such as furnaces, ductwork, vents, stokers, boilers, heating pipes & radiators; electrical systems & components such as wiring, outlets & light fixtures that are physically incorporated into the real estate; central air conditioning systems, ventilation systems & components thereof that are physically incorporated into the real estate; built-in cabinets & other woodwork that are physically incorporated into the real estate; built-in appliances such as refrigerators, stoves, ovens & trash compactors that are physically incorporated into the real estate; and floor coverings such as tile, linoleum & carpeting that are glued or otherwise permanently affixed.

- The Investment Tax Credit is a 0.5% credit against the state income tax for investments in qualified property placed in service in an Enterprise Zone.

- The EZ Machinery and Equipment Sales Tax Exemption provides a 6.25% state sales tax exemption on all tangible personal property used or consumed within the Enterprise Zone in the process of manufacturing or assembly of tangible personal property if a business creates a minimum of 200 full-time equivalent jobs, retains a minimum of 2,000 full-time jobs or retains 90% of the existing jobs, all within Illinois.

- The Utility Tax Exemption provides a 5% state tax exemption on gas, electricity and the Illinois Commerce Commission for a business making an investment in an Enterprise Zone that creates a minimum of 200 full-time equivalent jobs or retains a minimum of 1,000 full-time jobs in Illinois.

Assistance

As program facilitators, Heather Wick and Kim Coniglio at Growth Dimensions or (815) 547-4252 can help any business through the steps necessary to realize Enterprise Zone benefits. The Enterprise Zone Program is administered at the state level by the Illinois Department of Commerce and Economic Opportunity. For general information on the program, visit the Illinois Enterprise Zone Program website or call the Bureau of Business Development at (217) 524-0165.

* Please note: Eligibility requirements must be met to receive Enterprise Zone benefits.

More Topics

ComEd Financial Assistance Options

Aug 27 2020