Boone County Businesses Can Benefit from a Foreign Trade Zone

2 Nov 2020

News

Businesses within Boone County can take advantage of the benefits a Foreign Trade Zone allows! Growth Dimensions Economic Development is available to help local businesses step through the specifics necessary to ensure companies receive the maximum benefits possible.

A Foreign Trade Zone (FTZ) is a partnership between the U.S. government and private sector importers to create specially-designated locations considered to be outside of the U.S. Customs territory. FTZ’s help reduce the cost of manufacturing, making domestic manufacturing more cost competitive than overseas production. For example, cargo arriving in the country for an FTZ operator does not immediately clear U.S. Customs and receives preferential treatment with duties deferred, reduced or eliminated.

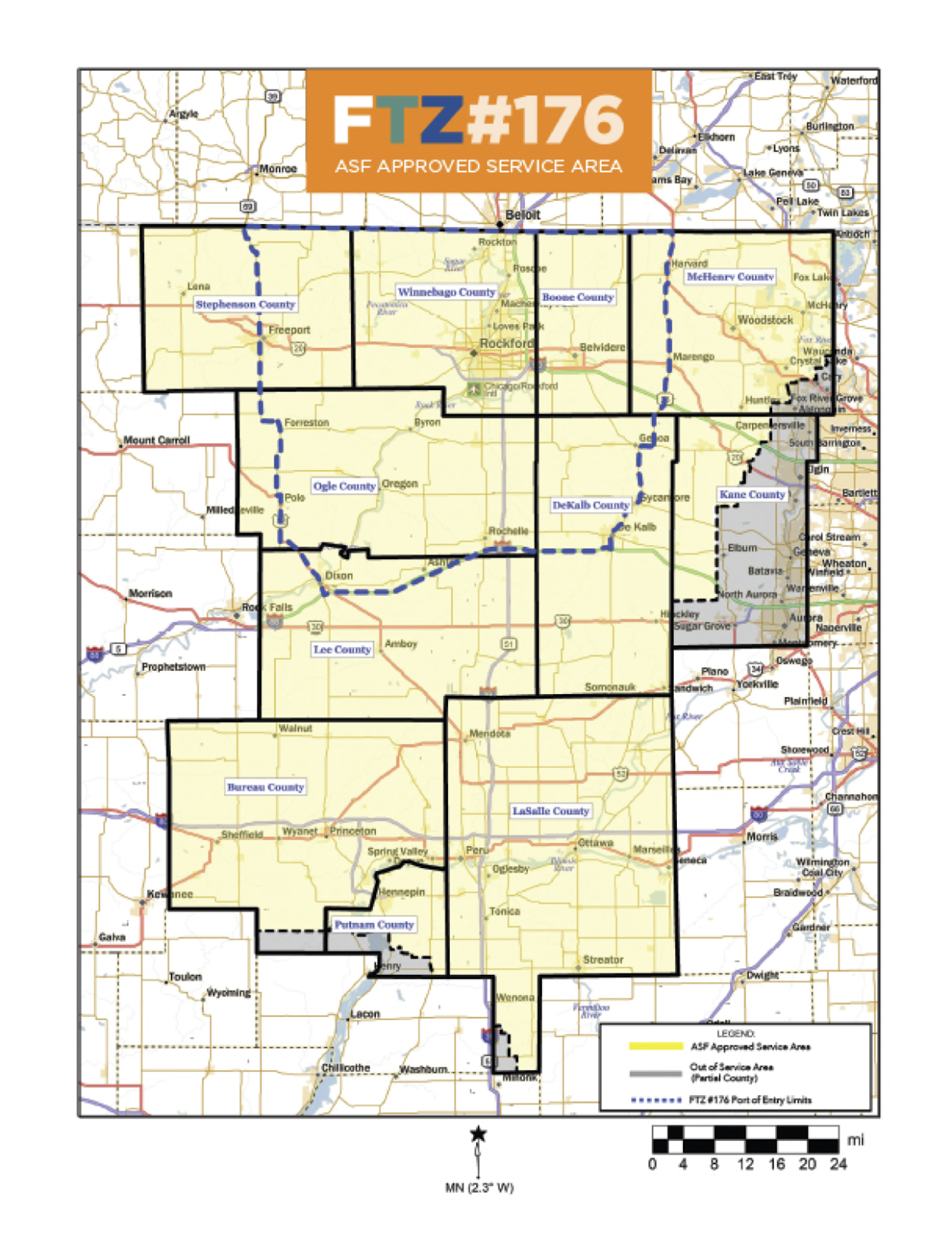

Companies in Boone County can apply to become a FTZ or subzone through FTZ #176 Rockford and the Greater Rockford Airport Authority. The National FTZ Board approved the Greater Rockford Airport Authority’s application in 1991 to become a grantee of the FTZ program, and expanded it in 2007 to serve a defined 11-county service area in northern Illinois, which included Boone County.

Foreign Trade Zone Benefits

- Cash Flow Savings - businesses only pay duties on imported items as they leave the FTZ and enter domestic territory.

- Supply chain timeline - businesses do not need to hold product for customs clearance, which can reduce the supply chain by a few days.

- Duty deferral - a business's average inventory receives a duty deferral during the first year in the FTZ program with capital costs captured each subsequent year.

- Duty elimination - most exports, returns, scrapped product and consumed merchandise are not subject to duties.

- Inverted tariff - finished products from FTZ manufacturing are subject to the duty rate applicable when it leaves the FTZ, a significant saving if they have a lower duty rate than the foreign input rate.

- Value Added - value added to merchandise in an FTZ is not dutiable.

- Production equipment - certain duty deferral and reduction benefits apply on production equipment admitted to the FTZ for assembly and testing prior to use in production.

- Zone transfer - transfer merchandise in bond to another FTZ without an entry.

- Weekly entry - reduce paperwork and save money by replacing individual or daily entries with one weekly entry.

Application Steps

Businesses should consider applying if they are located within 60 miles or 90 minutes of the Rockford Port of Entry, which is the Greater Rockford Airport and is in the FTZ #176 Service Area. Additionally, businesses which import a significant amount of products with a high value, re-export a substantial percentage of import or hold significant value of imported inventory are likely beneficiaries.

FTZ #176 offers a no-cost feasibility analysis to determine which businesses may benefit. The FTZ #176 Administrator is Carrie Zethmayr, who can be reached at 312-221-1115 or via email at carrie@zethmayr.com. Necessary company information for the analysis includes the total annual value of imported merchandise, number of customs entries made annually, total annual Merchandise Processing Fees paid, average number of inventory turns for the previous year, HTS list of imported merchandise and FTZ list of finished product if manufacturing occurs.

Further Assistance

As program facilitators,the Growth Dimensions Economic Development Team can be reached at (815) 547-4252 or info@growthdimensions.org to help any business through the steps necessary to realize Foreign Trade Zone benefits. For general information on the program, visit the National Foreign Trade Zones Board website.

More Topics